What does the new Apple TV deal mean for MLS?

/By Jared Young

If you’re reading this, you’ve seen the headlines. $2.5 BILLION dollars for Major League Soccer. A relationship with APPLE. NO Blackouts!

The last domestic TV deal signed in 2015 totaled roughly $720 million, so this seems like a pretty big step up. Perhaps MLS will finally be a league of choice. It is 2022 after all.

As usual, to get at something closer to the truth we must go beneath the headlines. There are a few drivers of the headline value that need to be unwound to determine just where we might expect MLS to go from here and how this might transform the quality on the pitch.

For starters, the Apple deal is a 10-year deal, compared to the expiring 8-year deal with ESPN and Fox. Let’s get this thing annualized.

Apple per year: $250 million

Prior domestic deal per year: $90 million

But that’s not all there is. According to The Athletic, there are more deals in the works with ESPN, and potentially Fox, that could get the total annual package up to $300 million.

Adding International deals to the current MLS agreements reportedly reaches $105 million.

That puts the estimated final package at $195 million greater per year. So far so good.

But now we have to subtract a few things. First, MLS must pay production costs, not Apple. The NFL Network spends $1 million per broadcast for an NFL game, but it’s safe to say that Garber won’t pony up for quite that level of quality. I don’t expect to see Tony Romo or Tom Brady doing the broadcasts any time soon. The Athletic estimates this annual expense at $60 million per year, which puts the average production cost per game at roughly $120K. Let’s run with it.

Next, the wonderful feature of No Blackouts comes at a cost, which is that the local television deals go away. The LA Galaxy reportedly had a $5.5 million annual deal, and LAFC was better at $6 million. It’s tough to say what the total deals of all 28 teams would add up to, but the details of the collective bargaining agreement might give us a clue.

The last CBA had a television revenue sharing component included. Players will get 12.5% of any television revenue above $165 million annually in the 2023 and 2024 seasons. This number goes up to 25% from 2025 through the end of the agreement in 2027. That $165 million likely includes the total value of all national and local agreements at the time the deal was struck. That would imply the value of local coverage might be around $60 million.

If you’re willing to assume that with me, let’s see what the scoreboard says.

Total new annual television net revenue: $240 million

Prior annual television revenue: $165 million

We’re down to $75 million per year pretty quickly. And remember $50 million of that has yet to be realized.

Lastly, there are now more teams in the league than during the prior television deal. The league averaged 23.75 teams from 2015 to 2022. While we don’t know the average number for this deal, it’s very possible the league reaches 32 teams in the next 10 years. Given this deal starts with 29 teams, let’s assume the league averages 30 teams over the next decade of league play.

The final math:

Total new annual television net revenue per team: $8.0 million

Prior new annual television revenue per team: $6.9 million

The television deal in 2014 netted each team about $1.3 million per year, so this step up isn’t quite as impactful as last time.

I’m not going to sit here and tell you that potentially adding $1 million dollars to each team’s payroll is a bad thing. It is good, especially when you consider that MLS’ television ratings haven’t been growing as much as anyone who loves the league would like.

Let’s zoom out a bit and see where this new $2.5 billion and Apple might take the league from a salary perspective by 2032. From there we can see just how competitive this league will become.

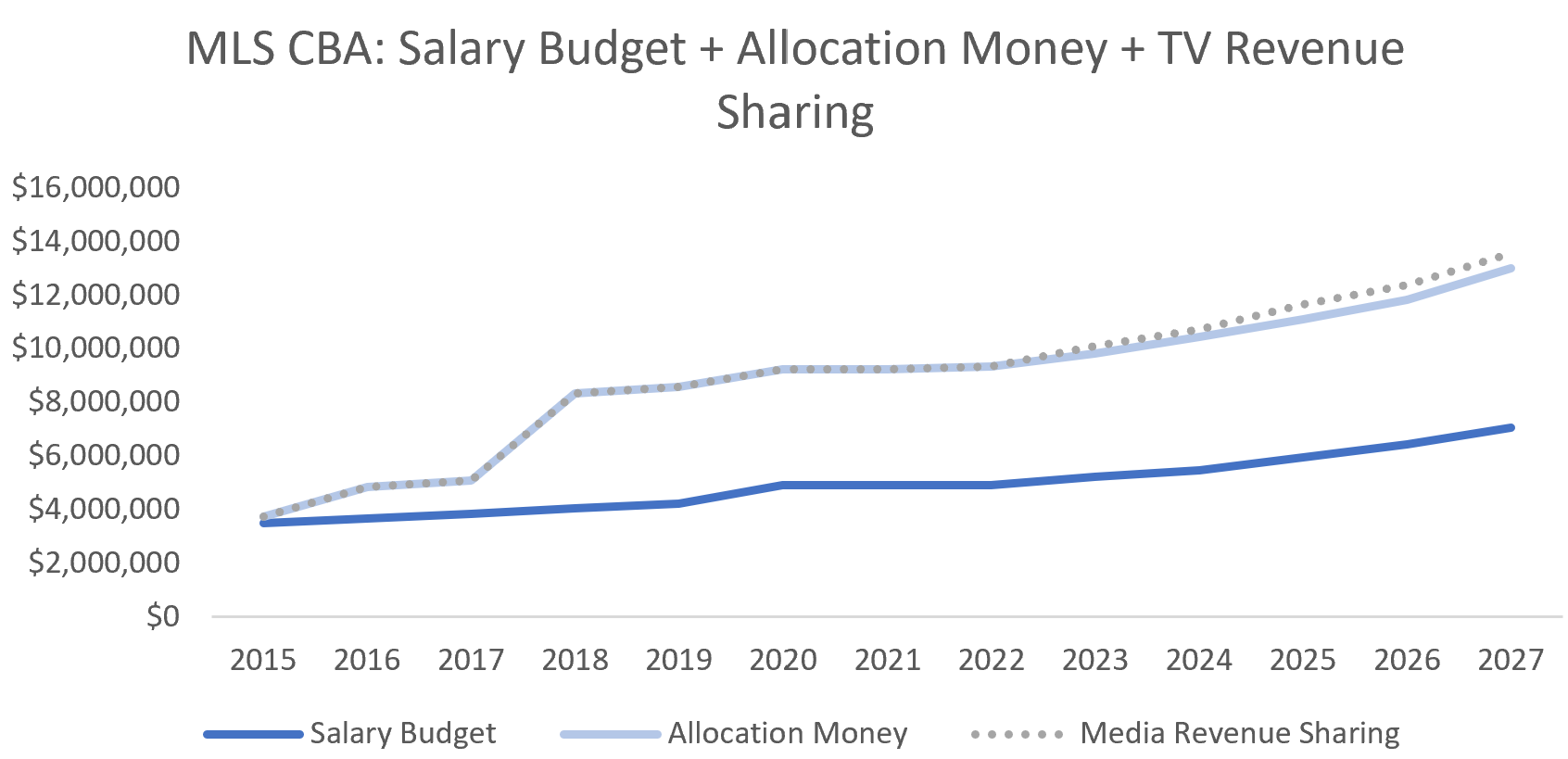

Let’s start with the league Salary Budget, Garber Bucks-er-I mean Allocation Money, and this new Revenue Sharing expected to arrive.

As you can see, the Revenue Sharing will barely move the needle, at least contractually. Following the last TV deal, fans were pleasantly surprised by the generous inflow of TAM in 2016 and beyond. Perhaps the league will lavish us peasants again with more of that sweet nectar. But otherwise, that’s what the contractual obligations of the league are to the teams.

Thanks to Designated Players, teams spend a good bit more than this budget. Here’s a look at the ratio of actual average spend versus the Budget+Allocation+Revenue Sharing numbers reported above.

In 2022, that number is approaching 1.5, so let’s assume that owners hold that ratio flat as we start out this new television deal. 2015 was that high as well, but last time there was a new television deal and a new CBA that year. This time there is no such new obligation coming to the payroll, so 1.5 seems like a reasonable assumption.

There will be a new deal in 2028, however, and we need to make an assumption for what that negotiation will bring. Given the new television deal is only worth about $1.1 million per team per year, and the revenue sharing agreement already contractually commits roughly half of that to the teams, there’s not likely to be a magic revenue windfall driving additional growth beyond 2027.

The result of the assumptions made from 2023-2027 puts the average salary growth rate at 8% per year. Let’s assume that same rate of growth through 2032. Perhaps that’s a little conservative, but even if the league grows a very strong 10% per year starting 2028, that only changes the final answer by $3 million per team.

Here’s what the salary projection looks like.

Light blue line is the projected average salary per team

By the end of this deal the league should average about $30 million per team, which gets to that nice round number of a $1 million salary per rostered player.

Let’s put that in context. According to capology.com, Club America in Liga MX spent $845k per player during their most recent season. Promoted Championship club Bournemouth just spent $1.2 million per player. Another club close to the $1 million dollar mark is 1899 Hoffenheim in the Bundesliga, which also paid out $1.2 million per player last season.

A million dollars per player in today’s dollars doesn’t really get MLS franchises in the conversation of top teams of the world, but those are some notable clubs for sure. The problem is wages around the world will continue to rise each year, as they always do. That means that even in 10 years, MLS team won’t be paying enough for talent to realistically compete against the clubs I just listed, not to mention major clubs.

However you want to define “league of choice”, the Apple TV deal isn’t the magic bullet that will bring MLS to the level of the world’s top leagues. It is a good step forward, though, and ensures that MLS will continue to grow their investment in players at a strong rate. And who knows, maybe the 2028 CBA will be a game changer that blows all of these numbers away. That’s what the headlines would lead us to dream anyway.