How Valuable Are MLS Teams Compared To Other U.S. Leagues?

/| Team | Value ($M) | Revenue ($M) | Operating Income ($M)1 |

|---|---|---|---|

| Seattle | 245 | 50 | 10 |

| Los Angeles | 240 | 44 | 4 |

| Houston | 200 | 26 | 5 |

| Portland | 185 | 35 | 4 |

| Toronto | 175 | 32 | -7 |

| Kansas City | 165 | 29 | 4 |

| Chicago | 160 | 21 | -6 |

| New England | 158 | 25 | 7 |

| Dallas | 148 | 25 | -3 |

| San Jose | 146 | 13 | -1 |

| Philadelphia | 145 | 25 | 2 |

| NYRB | 144 | 22 | -9 |

| D.C. | 140 | 21 | -1 |

| Montreal | 128 | 22 | -3 |

| Vancouver | 125 | 21 | -6 |

| Columbus | 112 | 18 | -4 |

| Salt Lake | 108 | 17 | 1 |

| Colorado | 105 | 15 | -3 |

By Jared Young (@jaredeyoung)

You don’t need actual profits to create a lot of financial value. Just ask Twitter. The potential to generate profit in the future is plenty enough for investors. Because of this paradigm, MLS Commissioner Don Garber repeatedly insults our intelligence when he emphasizes the league is losing money. And now Forbes, in so few numbers, agrees. According to Forbes, the league is generating negative EBITDA (earnings before interest, taxes, depreciation and amortization) but the value of MLS franchises has increased by 50% over the last two years. Forbes doesn’t offer much detail, but perhaps looking at other sports projections can help put the numbers in context.

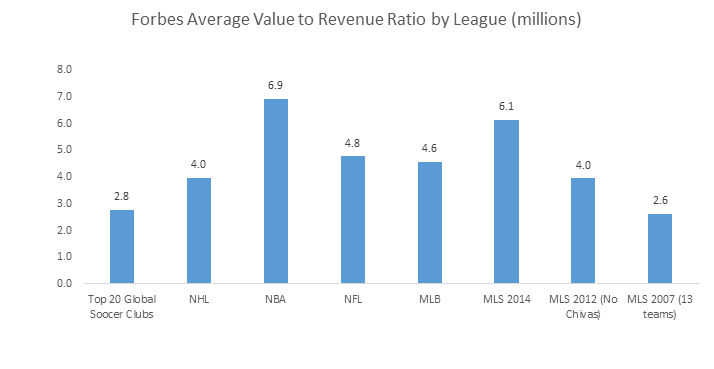

First let’s start with a bit of humble pie for American soccer fans. Below is the average value of a team across the major sports, including Forbes estimate of the top 20 most valuable soccer clubs globally. MLS figures include valuations from 2007, 2012 and now 2014.

The NFL are the true kings of sports finance but the largest soccer clubs, Major League Baseball and the NBA are duking it out for 2nd place. MLS looks longingly up at fifth place hockey. But growth is the name of the game for a sport that is small in a massive American market and huge globally. Average franchise values have increased 4.7 times (average increase of franchises playing in both 2007 and 2014 seasons is 4.0) which is higher than any other league. It can be good to be small.

Now time for some more of that aforementioned humble pie.

Obviously worth noting that the top global soccer clubs can generate some serious revenue, far more than NFL teams. MLS has a long way to go before they are competing with the big boys, and revenues have stagnated through 2014, if you believe Forbes. It’s worth noting that the revenue numbers don’t contemplate the new television deal worth more than $3M per team per year from 2015 on.

MLS isn’t turning that revenue into profit either as they continue to invest in league academies, USL teams and new stadiums.

Looking at the operating margin of the global soccer clubs coupled with their very strong revenue it’s hard to determine why Forbes doesn’t value them higher. One answer is be that the growth potential is limited relative to the American sports leagues, but that seems hard to imagine.

The NFL again is the clear leader in operating margin, and it’s not by accident because they have the tightest control over player salaries. There have a hard salary cap and have no guaranteed contracts. Meanwhile, Major League Baseball has the lowest operating margin but also has the most open market for players of all the American sports leagues.

The soccer business model comes out looking very good through this lens. The top 20 soccer clubs compete in a completely open market for players and have very high wage costs. Despite that they generate a considerable operating margin. Smaller clubs may struggle, but that is why MLS has maintained tight controls on player salaries as they grow. Given the single entity structure it’s reasonable to project that MLS could have margins in the range of the global soccer clubs and the NFL.

MLS also has the benefit of tremendous growth potential. They attract a young demographic and play in the world’s biggest market financially. This coupled with their operating margin potential is why Forbes has their value to revenue ratio so high.

Only the NBA has a better value to revenue ratio than MLS according to Forbes, a ratio that has more than doubled since 2007. And herein lies the story from a financial perspective for MLS; profits may be limited now, but growth and the potential for a healthy operating margin in the future add up solid returns so far for existing owners. That is why potential owners continue to knock on Garber’s door and why Garber continues to answer the call. Garber says MLS won’t stop at 24 teams and the USL just announced their 27th team on Wednesday after just six seasons of existence. NASL has added two clubs for 2016 as well. The United States is witnessing tremendous soccer expansion across all divisions. Plenty of owners are buying into the potential. Profits can wait.